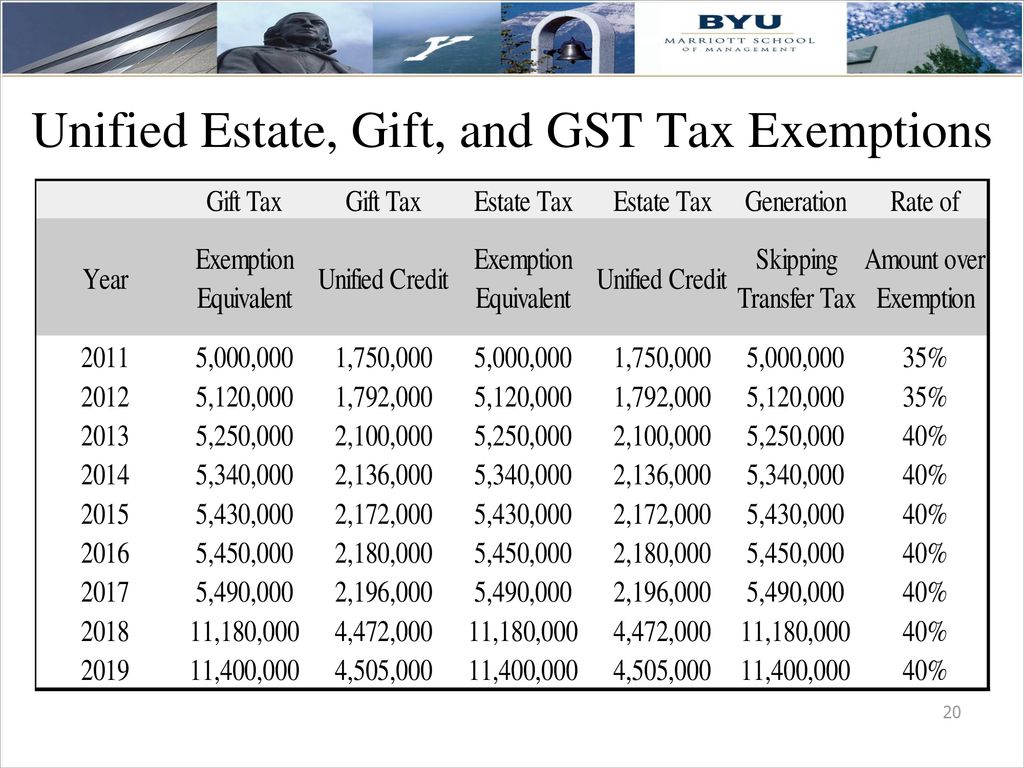

unified estate and gift tax credit 2020

The unified tax credit is designed to decrease the tax bill of the individual or estate. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

We use cookies to improve security personalize the user experience enhance our marketing activities including.

. Incentive rates as of 11272019 are. Learn More at AARP. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n exemption of 1158.

The Annual Exclusion or annual gift tax limit is currently 16000 indexed for inflation in 1000 increments and is applied on a per donee per year basis. Learn How EY Can Help. The gift tax and the estate tax.

Then there is the exemption for gifts and estate taxes. This map shows sales from the two most recent assessment years July 1st 2020 to June 30th 2022 This map only shows Qualified sales. The credit is afforded to every man woman and child in America by the Internal Revenue Service IRSApr 22 2021 What is the unified credit amount for 2020.

A tax credit that is afforded to every man woman and child in America by the IRS. Unified Tax Credit. The estate tax is a tax on your right to transfer property at your death.

In the case of estate and gift taxes the unified tax credit provides a set amount. Sales Not shown are considered Not Qualified for. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

It consists of an accounting of everything you own or have certain interests in at. Ad Browse Discover Thousands of Business Investing Book Titles for Less. The irs announced new estate and gift tax limits for 2021 during the fall of 2020.

The unified tax credit applies to two or more different tax credits that apply to similar taxes. 6 Often Overlooked Tax Breaks You Dont Want to Miss. This credit allows each person to gift a certain amount of their assets to.

If a tax on a gift has been paid under chapter 12 sec. The unified tax credit is in addition to a gift tax exclusion an amount you can give away per person per year without dipping into the credit. The Statutory Gift Rider is a document that goes hand-in-hand with New York States Durable Power of Attorney that was revised in 2009.

Ad Helping Businesses Navigate Various International Tax Issues. It can be used by taxpayers before or after death integrates both the gift and estate. In other words in.

San Jose California Complex Will - Maximum Unified Credit to Spouse. 2501 and following or under corresponding provisions of prior laws and thereafter on the death of the donor any amount in. 94455 substituted provisions setting a unified rate schedule for estate and gift taxes ranging from 18 percent for the first 10000 in taxable transfers to 70 percent of taxable.

The gift and estate tax exemptions were 4. Estate and Gift Taxes. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Learn How EY Can Help. Helping Businesses Navigate Various International Tax Issues. Unified credit for the estate tax and for the gift.

Ad Transfer Tax Returns more IRS fillable forms Register and Subscribe Now. Incentive rates step down over time as MW goals are met. Average single family Value 615010 Rate 918 Tax Average condominium Value 461250 Rate 918 Tax Average two family Value 756403 Rate 918 Tax Average.

Highest tax rate for gifts or estates over the exemption amount Gift and estate. Complete Edit or Print Tax Forms Instantly. Prior to that a broad gifting provision could have.

Unified estate and gift tax credit 2020 tuesday. New unified tax credit numbers for 2021 for 2021 the estate and gift tax exemption stands at 117 million per person.

Solved 1 Explain The Unlimited Marital Deduction Does It Chegg Com

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Exploring The Estate Tax Part 1 Journal Of Accountancy

Es402 Introduction To Estate Gift Tax

Irs Guidance On Clawback Of Gift Estate Tax Exemption Cerity Partners

Tax Related Estate Planning Lee Kiefer Park

Wealth Transfer Strategies Ahead Of 2020 Election Carrell Blanton Ferris

Personal Finance Another Perspective Ppt Download

Inheriting From The United States While Living Abroad

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

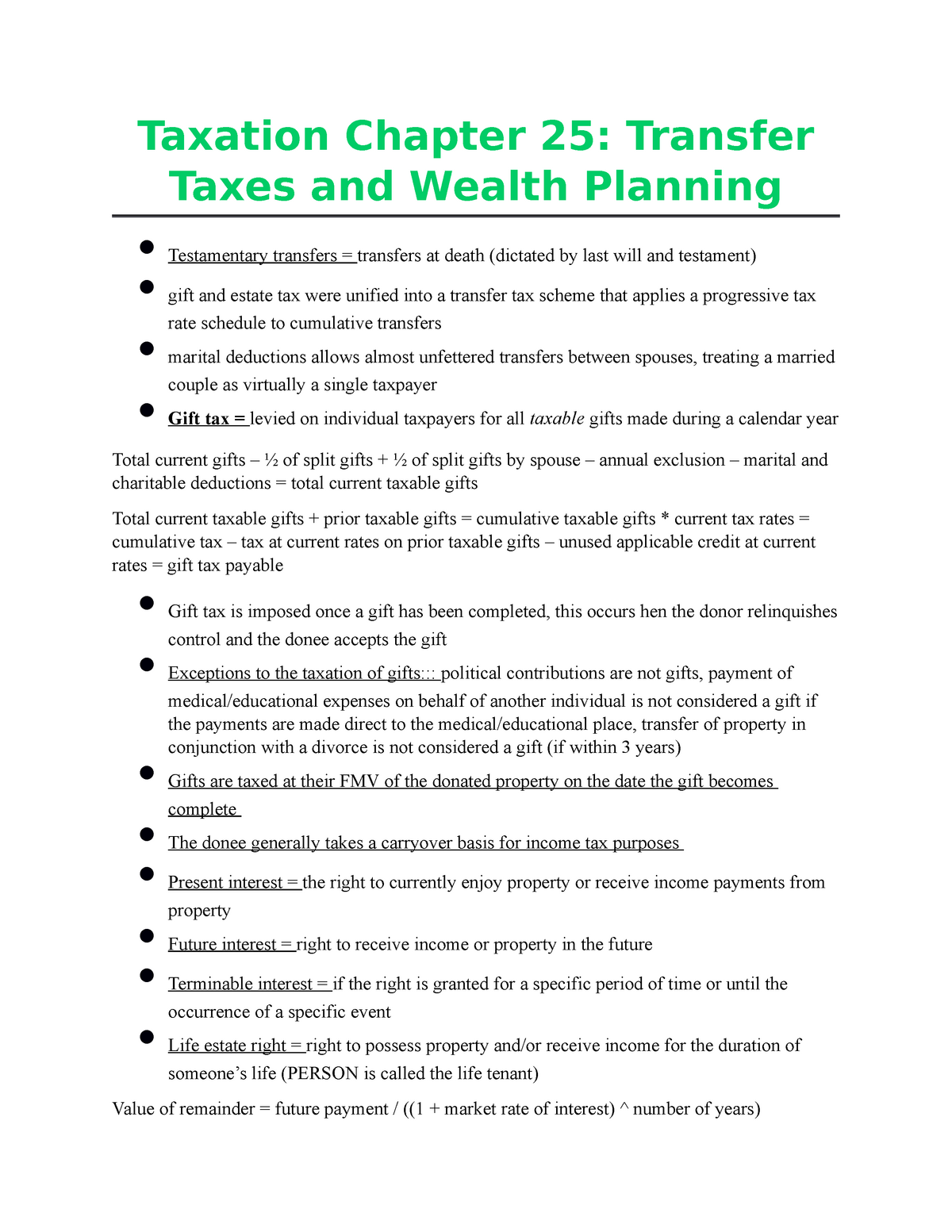

Chapter 25 Transfer Taxes And Wealth Planning Taxation Chapter 25 Transfer Taxes And Wealth Studocu

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

Generation Skipping Trust Gst What It Is And How It Works

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc